ANNUAL REPORT FY 2021

Fiscal Year ended 6/30/21

https://www.lifairhousing.org/wp-content/uploads/2022/06/LIHS-Annual-Report-2021.pdf

Long Island Housing Services’ mission is the elimination of unlawful housing discrimination and promotion of decent and affordable housing through advocacy and education.

Dear Friends of Fair Housing:

Preparing this annual report provided the opportunity to review and be thankful for all that has been accomplished. For Long Island Housing Services (LIHS) FY 2021 (7/1/2020-6/30/2021) was filled with incredible challenges, major growth opportunities and landmark accomplishments. Some of the highlights were:

Served on the Suffolk County Fair Housing Task Force; Suffolk County Disabilities Advisory Board; and active Member of the National Fair Housing Alliance

Served on the Suffolk County Fair Housing Task Force; Suffolk County Disabilities Advisory Board; and active Member of the National Fair Housing Alliance- Outreach to and collaboration with HUD-approved Housing Counseling agencies and related associates to prevent foreclosure

- Developed or updated numerous new bilingual outreach materials to educate and serve the public about services available, including adding Creole and Chinese. Additional resources can be found at https://www.lifairhousing.org/resources-links/;

- Maintained Certification as a HUD-approved Local Comprehensive Housing Counseling agency through meeting and exceeding performance standards subsequent to intensive reviews and related, detailed required reporting and documentation submissions;

- Received GuideStar Platinum Seal for Transparency.

Note LIHS’ final audit for the most recently ended Fiscal Year: 7/1/2020 to 6/30/21 is available at https://www.lifairhousing.org/wp-content/uploads/2022/02/21-LIHS-FINAL-fin-stmt.pdf. A roster of officers and members of the board, is available at https://www.lifairhousing.org/about/directors/

Note: Program-specific reports below.

Fair Housing

Six (6) Cases Settled: 1 source of income, 2 familial status; 1

source of income & Disability; 3 disability

- Settled 18-040: Source of Income. Long Island Housing Services, Inc. v. New Highway Apartments, et al. Resolution: $10,000. Affirmative Relief (Fair Housing Training; non- discriminatory policy, etc.)

- Settled: 16-016 Familial Status. Maritza Arriola Avila v. Susan Dedes; Kerri Mulry: Resolution: $3,500.

- Settled: 18-055: Disability and SOI. Long Island Housing Services, Inc. v. Coldwell Banker et al. Resolution: $6,000. Affirmative Relief (Fair Housing Training; non- discriminatory policy, etc.)

- Settled: 19-019: Familial Status. John Salvi and Ann Salvi on their own behalf and on behalf of their minor children v. Heather wood House at Oakdale LLC, et al. Resolution: $17,000.

- Settled: 20-019 Disability. Felicita Castro V. Cow Bay Housing Development Fund Company, Inc., Cornell Pace Inc., Lyette Arroyo: Complainant a filed a complaint of disability with HUD, which was subsequently referred to NYSDHR. Complainant alleged that she experienced discrimination based upon disability. Resolution: RA Accommodation granted with NYSDHR PDCA; waived $22,554 of rent arrear.

- Settled: 18-009 Disability. Richard Donovan v. Debbie Menna: Complainant a filed a complaint of disability with HUD. Resolution: $1,800.

- Settled: 20-032 Disability Deborah Juda v. Empire Management; Rosewood Equities LLC; Carmen Aponte. Resolution: RA Accommodation granted with HUD Conciliation Agreement.

Eleven (11) cases filed; 8 source of income; 1 disability; 1 case which related to both source of income & familial status cases; 1 age discrimination

- Filed 20-004 LaRae Jones, Joseph Jones v Harold Saunders, Coldwell Banker et al.: This complaint of source of income discrimination is filed with NYSDHR. This case been dismissed by the NYSDHR.

- 20-047 Long Island Housing Services, Inc. v. Campbird Management Co., LLC; Brookwood at Ridge; Abbey “Doe”: LIHS filed a complaint of SOI discrimination with NYSDHR. All parties agreed to settle. LIHS received the draft pre-determined conciliation agreement from NYSDHR. LIHS is waiting for respondents to execute the agreement.

- 20-040 Ladania Copelin v. Campbird Management Co., LLC; Brookwood at Ridge; Brookwood at Islip, Brookwood at Holbrook, Brookwood at Sayville, Brookwood at Oakdale, Brookwood at Bay Shore, Abbey “Doe” Yolanda “Doe”: A complaint of SOI discrimination was filed with NYSDHR. All parties agreed to settle. LIHS is waiting for respondents to execute the agreement.

- 20-039 Long Island Housing Services, Inc. v. Kennedy Realty, Inc., Anthony Kennedy, Lawrence Sydelman: A complaint based on SOI and familial status discrimination was filed with NYSDHR. NYSDHR issued a PC determination.

- 19-089 Giacomo Farneti v. Campbird Management Co., LLC; Brookwood at Ridge; Abbey “Doe”: A complaint of SOI discrimination was filed with NYSDHR. All parties agreed to settle. LIHS is waiting for respondents to execute the agreement.

- 21-072 Lucile Alexander v. Bayview Terrace; 385 Bayview LLC; E & M Management: A complaint was filed with HUD based on disability discrimination.

- 21-028 Nicole McFarlane v. Arthur T. Mott Real Estate, LLC; Stephanie Hernandez; 55 Nassau Place, LLC: Complaint was filed based on SOI discrimination with NYSDHR. A PC determination has been ruled by the NYSDHR.

- 21-006 Michelle Souter v. Glen Arms: A complaint was filed based on SOI discrimination with NYSDHR. A PC determination has been issued by the NYSDHR.

- 21-019 Tanya Hogan v. Barone Realty: The source of income discrimination complaint was filed with NYSDHR. A PC determination has been issued by the NYSDHR.

- 21-018 Tanya Hogan v. Cross County Realty: The source of income discrimination complaint was filed with NYSDHR. The complainant settled for $1,000.

- 20-051 Stephen Price v. Winchester. Complaint was filed with NYSDHR based on age discrimination.

- Investigated allegations of unlawful housing discrimination in rentals, sales, lending and advertising cases some resulting in formal enforcement actions;

- Facilitated enforcement services for prima facie complaints with U.S. Dept. of HUD and/or the NYS Division of Human Rights and local Human Rights Commission after investigations revealed evidence to pursue enforcement,

- Dramatically increased number of housing units accessible to people with disabilities through advocacy services and enforcement efforts to include affirmative relief provisions in the public interest;

- Provided Fair Housing training for staff, government, housing industry, the public, private and non-profit agencies;

- Maintained Fair Housing Enforcement program manager, investigators, and Resource specialist providing counseling services on rental topics and program support;

- Continue to support 1 Full time Fair Housing Staff Attorney, admitted to practice in Federal and NYS Courts;

- Attendance of refresher course by Per Diem Testers on fair housing testing. Access to active pool of Per Diem Testers trained to conduct fair housing testing. Recruited, trained and hired new fair housing testers.

Foreclosure Prevention

The Foreclosure Prevention program provides struggling homeowners with Housing Counseling and Legal Services.

Having just weathered a protracted funding gap from April through June 2020, Foreclosure Prevention received a 6-month commitment to carry us through Jan 15, 2021, and a renewal for an additional 6-month period through Jan 15, 2022. In addition to the late roll out of the grant, outreach to new clients continued to present a challenge while loan forbearances and foreclosure moratoria remained in place. During this period of decreased/suspended foreclosure activity in the courts, calls on our Foreclosure Prevention hotline had slowed.

On the other hand, calls to our Landlord/Tenant hotline increased substantially, and we responded by reassigning one of our housing counselors to provide rental counseling to Spanish-speaking Landlord/Tenant clients. We are also working with the Nassau County 5th Precinct to address complaints that officers have failed to respond to an illegal eviction, and have secured a commitment by both the Police Department and a fellow housing advocate who is a veteran Landlord/Tenant attorney to provide training to the officers on these important changes in NYS law. As of April 2019, it is a Class A Misdemeanor to evict someone illegally, including by shutting off their utilities.

Our Foreclosure Prevention program continued to provide all of our clients with the opportunity to consult with both a housing counselor and a staff attorney about their cases, and remained ever mindful of the needs of vulnerable populations at risk of falling through the cracks as our industry pivots toward high-tech solutions to social distancing.

Despite the challenges presented by the COVID-19 pandemic, Foreclosure Prevention was able to substantially complete and even exceed goals set for the period. Most notably, and not reflected in our goals for the grant period, Foreclosure Prevention assisted numerous homeowners to secure mortgage forbearances for which they were entitled and wrongfully denied.

Housing Counseling:

- Total Clients: 238 (out of 200)

- 119 % of total 12-month goal completed

- New Clients: 162 (out of 124)

- 131% of total 12-month goal completed

- Foreclosures Prevented: 25 (out of 24)

- 104% of total 12-month goal completed

Legal Services:

- Total Clients: 130 (out of 150)

- 87% of total 12-month goal completed

- New Clients: 87 (out of 107)

- 81% of total 12-month goal completed

- Foreclosures Prevented: (out of 16)

- 94% of total 12-month goal completed

Tenant’s Rights

Provided assistance to 296 clients seeking Tenant’s Rights counseling and provided screening for Fair Housing violations and First Time Homebuyer services.

Landlord-Tenant Success story: Suffolk County

Client lived with his girlfriend in a complex for about 3 months. Due to COVID he went on paid family leave losing 40% of his salary. His gf was not working either due to the fact she had a 2 -month old child and was concerned of the health risks. He was getting disability and he needed to find out if he can be evicted while waiting for rental assistance. He was 1 month behind in the rent at the time of the call. He also wanted to find out if he can qualify for unemployment due to his circumstances. He was still employed but did not feel safe working in the office as his newborn had medical issues.

Our Housing Counselor was able to connect him to the guidelines for the Pandemic unemployment, as well as rental assistance agencies. Housing Counselor also sent him the information about being able to use your security deposit towards a month’s rent during the COV19 crisis, and being able to make payment arrangements to pay it back over one year. He was successfully able to do this, using a template the Housing Counselor emailed him and he sent it to the LL with the guidelines attached. He also got approved for the Pandemic unemployment. They were able to stay in the apt.

Landlord-Tenant Success story: Nassau County

Client lives with fiancé in a complex. After moving in Nov. 2020 they requested their security deposit back of $2600, and gave them their new address in New Jersey. The property manager told them in December it as being processed and they would have it in 7-10 days. In January 2021 he followed up with them again, because he never received the security deposit back. In February 2021, he called them again, and then found us on the Internet. He did not want to have to come back to New York to file in small claims court. I gave him the New York State Attorney General’s security deposit complaint form and the new laws on security deposit returns. The Housing Counselor sent him a template requesting the return of his deposit. He wrote them another letter and cc’d LIHS this time. They did not respond to his written request.

In March the client signed a release form so the Housing Counselor could contact the complex on their behalf. After several e-mails and phone calls to the property manager, the client received his security deposit back by the end of April 2021 and they sent him the tracking number also. The check cleared the bank, and the client emailed me to thank the Housing Counselor.

Landlord-Tenant Services Provided:

- 269 Landlord/Tenant counseling intakes were created

- 123 clients had questions on evictions

- 80 clients were seeking housing options

- 46 clients were seeking info. on Warranty of Habitability issues

- 22 clients had questions on rent increases

- 8 clients needed info on emergency housing

- 25 clients had rent arrears

- 6 clients were screened for housing discrimination

- 13 clients living in a private home rental that was being sold were given information on their tenant’s rights concerning the eviction process and move out process

- 29 clients were given information on eviction, before the court process took place.

- 28 clients living in a private home rental that was being sold were given information on their tenant’s rights concerning the eviction process and move out process

LIHS Advocacy documents

LIHS has filed or signed on to the following documents demanding action to further fair housing:

- LIHS Support Memo on NYS A7737on Mortgage Acceleration June 8, 2021

- Comprehensive Debt Collection Improvement Act HR-2547-Support-Letter-2021-05-13

- 2021 Suffolk County Fair Housing Task Force Report (PDF); 2021 Fair Housing Task Force Final Recommendations (PDF) May 12, 2021

- Town of Islip ERAP concerns 4.27.21

- Coalition Letter True Lender CRA_4.20.21

- Stop Debt Collectors from Taking New Yorkers’ Stimulus Payments S5923A 4/13/21

- Long Island Housing Services COVID Exemption Bill Memo in Support S5923A A6617A (pdf)

- LIHS Budget Testimony supporting HOPP 020421

- HUD Single Family Handbook Loss Mitigation Comments 091120

- LIHS Letter Docket ID OCC-2020-0026 OCC Comment (payday lending) 9.2.2020 (pdf)

- Long Island Housing Services’ Memo in Support New York State Department of Financial Services’ Part 419 Private Right of Action, August 19, 2020 (pdf)

- New York State Homeowners Need Assistance, July 21, 2020 (pdf)

LIHS in the News

- Latest Eviction Moratorium Extension Has N.Y. Advocates Scrambling For Long Term Housing Solution, WSHU Public Radio, June 14, 2021

- Suffolk Fair Housing Task Force unveils recommendations to end housing discrimination, News12 Long Island, June 16, 2021

- Suffolk housing task force calls for undercover testing program, Newsday, June 13, 2021

- Banks Made Millions Off Of Long Islanders In Fees During COVID, Newsday, June 10, 2021

- Banks accused of soaking poor with fees amid pandemic, Newsday, June 9, 2021

- Law Review Podcast – Housing Discrimination in Long Island, May 23, 2021

- Only a tiny fraction of rental relief has reached LI landlords and tenants, officials say , Newsday, May 22, 2021

- Long Island renters, homeowners can get free housing help, Newsday, May 14, 2021

- Eliminating Barriers to Housing in New York: 2021 Convening

- Counties: Undercover testing to fight housing discrimination still in works, Newsday, February 28, 2021

- Cuomo: State to deploy testers to probe for housing discrimination, Newsday, February 25, 2021

- Biden issues executive orders to promote racial equity, Newsday, January 27, 2021

- LI rental complex reaches $11G settlement over housing bias allegations, Newsday, January 25, 2021

- Home and Hearth: Housing and Food Security During the Second Wave of COVID-19. WSHU, 91.1 FM , January 14, 2021

- Where LI renters can go for financial, legal help, Newsday, December 28, 2020

- The Long Island Power 100: 51-100, City & State, November 23, 2020

- Glen Arms Apartments paid $11,000 and agreed to anti-bias policies, group says, Newsday, November 6, 2020

- Lawsuit accuses real estate brokerage Redfin of discrimination, Newsday, October 30, 2020

- HUD charges LI condo complex with discriminating against resident who needed support dogs, Newsday, October 14, 2020

- LatinoJustice and Cleary Gottlieb Joined by Civil Rights and Anti-Poverty Law Groups File Amicus Brief Urging Second Circuit Court of Appeals to Find Blatant Tenant-to-Tenant Racial Harassment Actionable Against Landlord Under the Fair Housing Act, LatinoJustice press Release, October 1, 2020

- Suffolk legislators this week to consider two major land buys in Riverhead, bias-driven false reports to police and zombie homes (Committee Week Highlights), RiverheadLocal, September 29, 2020

- Newsday series leads state agency to conduct 35 fair housing investigations, Newsday, September 16, 2020

- NY Senate housing bias hearing, sparked by Newsday series, set to begin, Newsday, September 15, 2020

Created Equal: Are reparations owed to Blacks barred from buying property? Why some experts say yes, WPIX11, September 1, 2020

Created Equal: Are reparations owed to Blacks barred from buying property? Why some experts say yes, WPIX11, September 1, 2020- Created Equal: How the U.S. government has intentionally segregated communities for generations, WPIX11, August 31, 2020

- Suffolk Fair Housing task force focuses on need to enforce anti-bias laws, Newsday, August 13, 2020

- The Point:

Calling out for help to end housing segregation on LI, Newsday, July 30, 2020

Calling out for help to end housing segregation on LI, Newsday, July 30, 2020 - Household Economics In The Time Of COVID-19, WSHU Public Radio 89.9 FM, July 24, 2020

- HUD grants $360,000 each to two LI groups fighting housing bias, Newsday, July 9, 2020

- LI apartment complex to pay $35,000 in fair housing settlement, Newsday, July 7, 2020

- Donald Trump: Fair housing rules having ‘devastating’ impact on suburbs, Newsday, July 4, 2020

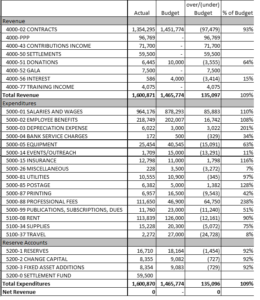

FY 21 Final Budget vs. Actual Narrative

Contract income was as expected throughout the year. Donation income did not meet expectations, probably due to a loftier goal than was feasible, but donations did track as similar to prior years. Interest income was much lower than initially expected. This was due to interest rates on savings accounts dropping to below 1%, not a reduction in the size of the accounts. As expected, our PPP Loan was 100% forgiven, and the portion not allocated in FY20 is represented as income here in FY21. Expenses were as expected. As we work to fully fund each program, we add to reserve accounts to better position our agency to deal with future funding disruptions. We hope to slowly build funds for reserves, money to make large organizational changes called change capital, and additions to our fixed assets that are difficult to build into annual and grant budgets. This year, after grant income is deferred to FY22 for use where appropriate, we can add $16,710 in our reserve fund, $8,355 into change capital, and $8,354 into fixed asset additions.

Social media and google translate